Pension Risk Transfer Services

A secure retirement for our annuitants.

What is Pension Risk Transfer (PRT)?

Pension Risk Transfer is a transaction that allows a defined benefit plan sponsor to mitigate risk and improve benefit security for plan members by transferring all or a portion of the plan to an insurance company. PRT is especially beneficial in helping plan sponsors manage market volatility and changing economic conditions.

PRT transactions enable companies to focus on what they do best – run their business and serve their customers. These transactions help simplify a company’s administrative processes, streamline backend operations and ensure a greater level of oversight and transparency in managing pension obligations.

Why Should Plan Sponsors Consider PRT?

Plan sponsors have executed PRT transactions for over 10 years in the US for various reasons, including the following:

Reduce their balance sheet risk: as mentioned above, PRT eliminates several pension-related risks from a company’s balance sheet.

Reduce costs: eliminating pension obligations also eliminates costs associated with administering participants. E.g. Pension Benefit Guaranty Corporation (PBGC) Premiums.

Simplify benefits operations: transferring pension obligations to an insurer removes a company’s need to maintain pension operations.

Eliminating pension related risks and operational complexities enables you to focus on what you do best – running your business and serving your customers. These transactions help simplify a company’s administrative processes, and streamline backend operations.

You may also be able to save on administrative and recordkeeping costs, investment costs, and Pension Benefit Guaranty Corporation (PBGC) premiums.

What Kind of Businesses Can Benefit from PRT?

Businesses of all industries can benefit from Pension Risk Transfer services. The best way to find out how Pension Risk Transfer could benefit your organization is to speak with one of our PRT experts. PRT is our specialty; no matter the industry you’re in, we have experience providing Pension Risk Transfer services to businesses like yours.

It’s important to note that your pension plan does not need to be fully funded to take advantage of Pension Risk Transfer solutions. Learn more about lift-outs below.

How Do I Know it’s the Right Time to Consider PRT?

You may know that a PRT transaction is right for your business but are unsure when to start the process. Even if you’re not ready just yet, start gathering your data and consider getting in touch to ensure you can complete the process at the next best opportunity. Ask yourself the following questions:

- What is your main driver? Is it cost savings or risk mitigation?

- Do you have the right data you need? Make sure you have complete electronic records of your plan data, including information on participants, beneficiaries, and death benefits.

- Take advantage of improved funding levels. When interest rates change, so do funding levels. If your plan is well funded, it could be a good time to consider PRT. Our PRT monitors can help you stay up to date.

If you need to eliminate or reduce costs associated with your pension plan and protect participants, it’s a good time to learn more about your PRT transaction options.

Our Pension Risk Transfer Solutions

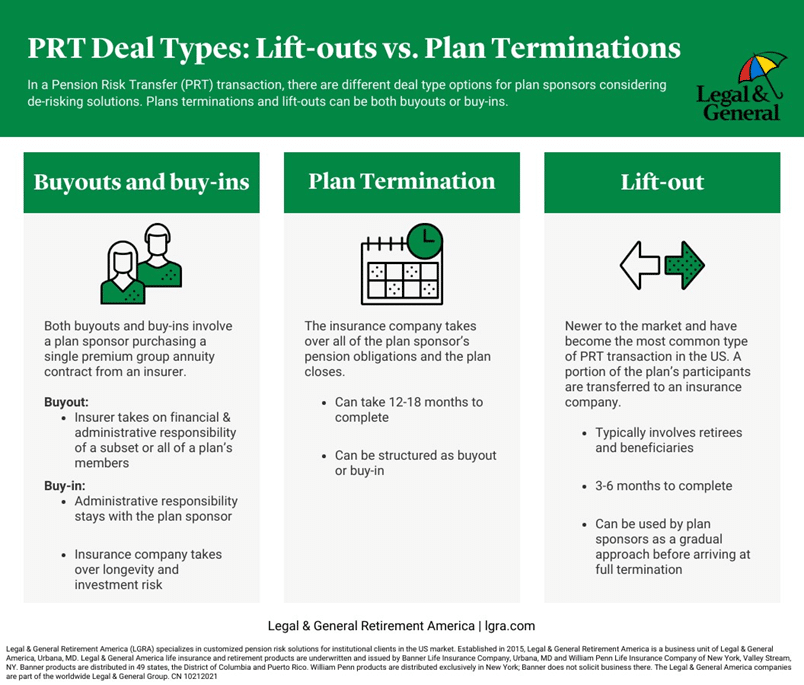

There are two main types of transactions available to complete a Pension Risk Transfer transaction; these are known as a “Lift Out” and “Plan Termination.” “Buyouts” and “Buy-Ins” are the methods via which these transactions take place. Here, we explore these solutions in greater detail.

Plan Termination

Plan termination means removing all risks associated with your pension plan entirely. All financial and administrative responsibility for the plan will be transitioned to an insurer, and you’ll stop paying associated costs and premiums. Group annuities and lump sum payments are two methods used to facilitate a plan termination. This process can take around 12-18 months to complete.

Lift-Out

Lift-outs are a great way to reduce pension risk if fully terminating your plan is not a viable option, if the plan isn’t fully funded, or you don’t have the financial means to terminate your plan. You will choose a specific portion of current participants within your plan that meet certain criteria and transfer only their benefits to an insurer. Group annuities are used to facilitate lift-outs and plan terminations, so your selected plan participants will continue to receive fixed payments, but the selected insurer takes on the responsibility. Lift-outs are less complex than full-plan terminations and can be wrapped up within a few months.

Buyouts & Buy-Ins

Both buyouts and buy-ins involve purchasing a single-premium group annuity to continue to support plan participants, via the chosen insurer.

Buyouts are the more popular solution in the US, as the insurer takes on the financial and administrative responsibility for the selected group (for a lift-out, this will be a subset of the plan’s members, and for a plan termination, this will be all of the plan’s members.)

Buy-ins are less common. With a buy-in, an insurer takes on the financial responsibility of paying the benefits, but the administrative activities remain the responsibility of the plan sponsor.

How to Prepare for PRT

Pension Risk Transfer is a significant process; start preparing now to ensure you can complete the transaction at the time that’s most financially beneficial for your organization.

- Sign up for Pension Risk Transfer monitors to stay updated on market trends and outlook.

- Get in touch with our PRT experts so you can start exploring options, tailor the strategy to your business needs, and act when the time is right.

- Ensure you have all electronic records up to date.

- Choose the Pension Risk Transfer method that’s right for you.

Trust LGRA for a Seamless Pension Risk Transfer Process

We’re here to work as an extension of your team, help you remove financial barriers and help you keep your promises to your plan participants at the same time.

We Specialize in Pension Risk Management

LGRA is a Pension Risk Transfer provider that specializes solely in completing PRT transactions and has extensive knowledge of the options available to you. We’re able to help you through challenges that are unique to your circumstances. In 2023 we reached a new milestone; $10 billion in total written premium and over 100 deals since our inception in 2015. In 2023 alone, we secured the retirement of over 27,000 annuitants. Some of our clients include, First Energy, PPG, and Rolls Royce.

A Proven Process

Our approach to client service and PRT administration has been continuously refined for nearly four decades spanning over one million annuitants. During the transition process, a dedicated Transition Manager will act as a single point of contact for all communication. They will have an in-depth understanding of your unique circumstances and will take a personalized approach to finding the best solution for you.

Financially Strong

LGRA is a trusted PRT partner with exceptional financial strength ratings; we offer a solid, stable, reputable solution.

Sign Up to Receive Pension Risk Transfer Market Updates

If you’re not ready to speak to a Pension Risk expert just yet, you can stay up to date on market trends, performance, and outlook by signing up for our quarterly PRT Monitor. Fill out the form to receive the Monitor directly to your inbox.

Get Started with Pension Risk Transfer

Getting in touch now is just the start of a process that could change the future of your company and increase financial security for your plan participants. Contact us to learn more about Pension Risk Transfer and find out if it’s right for you.

Interested in learning more about the PRT market and our industry insights?

What does a successful Pension Risk Transfer transaction look like?

In the PRT process, there are many key components to consider, from the initiation phase to the final step of onboarding new annuitants. As a plan sponsor, you’ll want to ensure you’re choosing the right insurer. Below is a brief overview of what to expect in the process of securing the financial future of your annuitants.

Check out our Quick Guide to PRT to learn more

Products We Offer

We offer customized solutions to meet the needs of our pension clients.

Our capabilities include:

We are happy to answer any questions you have about PRT and our solutions available to you.

Looking for life insurance?

Legal & General America is the US insurance division of Legal & General Group — leveraging the expertise of a top ten global insurer to deliver high-quality life insurance for American families and businesses.