PRT Monitors

Stay up to date with the latest PRT Market insights

Pension Risk Transfer Market Reports

Each year, the Pension Risk Transfer market continues to grow, new records are set, and more plan sponsors turn to pension de-risking strategies. Legal & General Retirement America is here to act as your guide, whether you’re taking a first look into PRT or staying abreast of market trends and performance to create a strategy for your business. Our comprehensive reports offer insight into transaction volume and the total market premium, to help you navigate the Pension Risk Transfer market and make informed decisions.

Pension Risk Transfer Monitor – HY 2025

Market Update

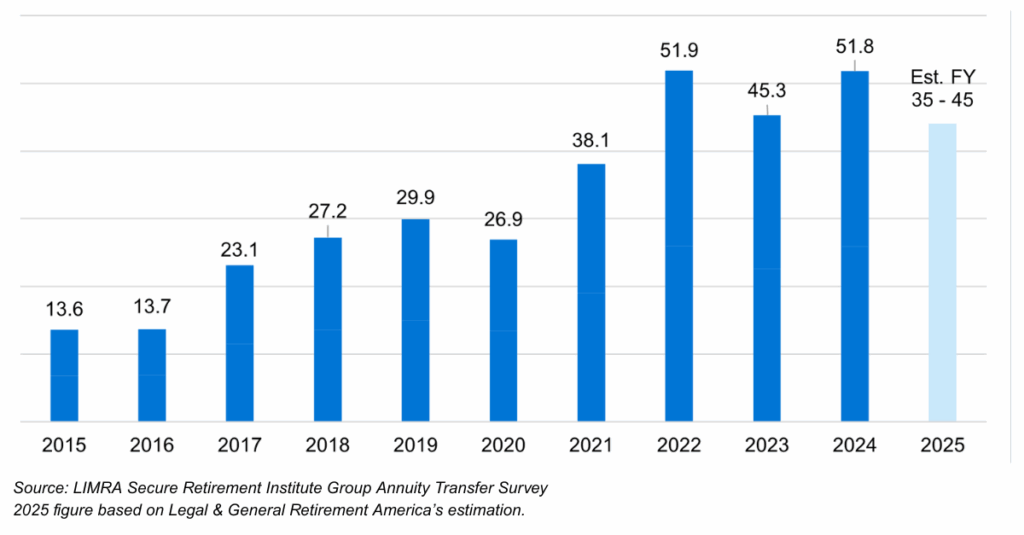

The US market also saw its second-largest year for PRT on record in 2024 with transaction volumes totalling $51.8 billion, only slightly behind the all-time record of $51.9 billion set in 20221.

Market volumes in the US continue to be driven by jumbo transactions over $1 billion. In 2024, seven such transactions closed for a combined total of approximately $22 billion, representing a significant portion of the annual market volume.

In 2025, activity has remained high in terms of the overall number of PRT transactions coming to the US market. However, the number of jumbo transactions has been lower in H1 compared to last year, which has impacted overall premium volumes.

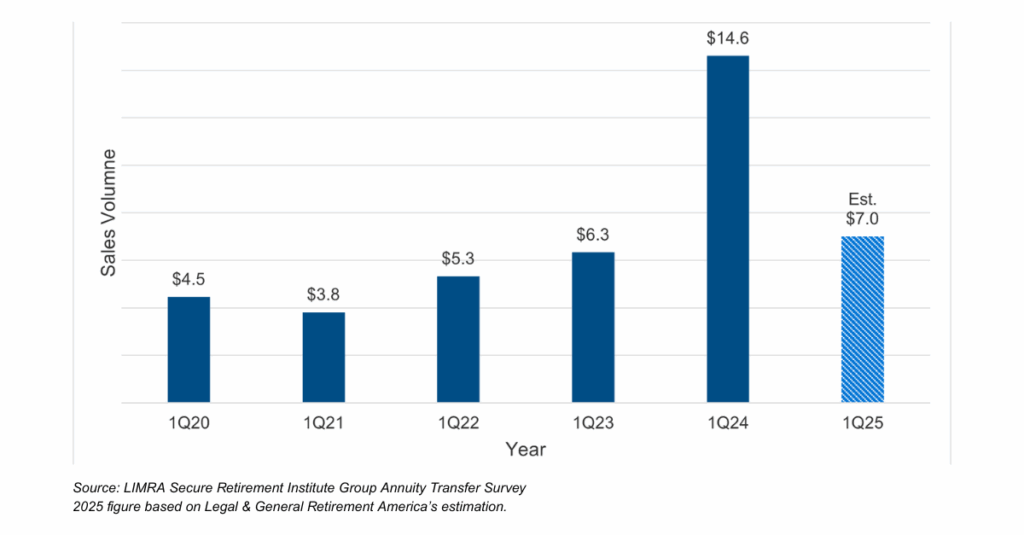

The first quarter of the year totaled $7.1 billion2, a decrease of over 50% when compared to the first quarter of 2024’s total volume of $14.6 billion3.

A similar story is expected for the first half market volume. We estimate the first half of the year to close at around $11 billion compared to $26 billion4 in 2024.

One jumbo transaction closed in the first half of the year for around $1 billion, whereas five of the largest transactions in H1 2024 totaled just under $15bn. If you remove the jumbo transactions, the first half of 2024 and 2025 would both be around $10 billion, highlighting the impact that jumbo transactions have in any year on total market volume.

Estimated size of H1 2025

Estimated size of Q1 2025

Market Developments

With increased economic uncertainty, some companies have shifted their focus away from de-risking their DB plans to focus on their core businesses but should pick back up again as the markets steady. As illustrated by the chart of US PRT volumes to the right, we saw a similar dynamic in the global pandemic, where the total market volume dropped slightly in 2020 and then quickly regained its momentum to have the three largest years on record from 2022 to 2024. The long-term outlook remains very positive. Between 2022 and 2025 we witnessed an aggregate c.$60bn of deal flow for the first half of the year, compared with c.$33bn for the three-year period before this.

One trend we are seeing in the US is a significant increase in the number of buy-in transactions coming to market. Though common in the UK, buy-ins are a newer trend in the US where traditionally, nearly all transactions have been buyouts with the plan sponsor transferring full responsibility of the plan to an insurer, including participant administration. We have seen a slow increase in buy-in transactions over the past few years, but we anticipate an over 50% increase this year compared to any prior year. The majority of these buy-ins are for full terminations, where the plan sponsor looks to lock in pricing early on in their termination process and transition to buyout when ready.

Like the UK , the number of insurers participating in the US PRT market continues to rise, with more than 20 insurers now providing PRT de-risking solutions to plan sponsors.

PRT Market Outlook

As is typical in the second half of the year, we expect US PRT activity to pick up through the rest of 2025, with a few more large transactions coming to market. These jumbo transactions will significantly impact the total premium volume, which we are currently estimating to be between $35 and $45 billion.

In February, we announced the creation of a long-term strategic partnership with Meiji Yasuda, a market leading Japanese mutual life insurance company. This partnership will allow us to drive growth in the US PRT business, while Meiji Yasuda will expand its established partnership with L&G in asset management by outsourcing the investment management of US PRT and protection assets to L&G.

In addition, we announced a long-term partnership with Blackstone in July. Through this partnership, we’ll gain access to a broader range of high-quality investments, predominantly in the US, using Blackstone’s private credit platform. We plan to invest up to 10% of our global new annuity business through this collaboration. Together, we’ll also develop new investment products that combine public and private credit, helping us reach more global wealth and wholesale markets.

Sources:

1.https://www.limra.com/en/newsroom/news-releases/2025/limra-u.s.-single-premium-pension-risk-transfer-sales-leap-14-to-$51.8-billion-in-2024

2.https://www.limra.com/en/newsroom/news-releases/2025/limra-first-quarter-u.s.-pension-risk-transfer-sales-top-$7-billion/

3.https://www.limra.com/en/newsroom/news-releases/2024/limra-u.s.-pension-risk-transfer-sales-post-record-high-first-quarter/

4.https://www.limra.com/en/newsroom/news-releases/2024/limra-u.s.-pension-risk-transfer-sales-jump-14-in-first-half-of-2024

5.https://www.limra.com/siteassets/newsroom/fact-tank/sales-data/2025/1q/u.s.-group-annuity-risk-transfer-activity–buy-out-sales-2025-first-quarter.pdf

Legal & General Retirement America, as an active participant in the US Pension Risk Transfer market, receives and analyzes in the normal course of its business certain information provided to it and other market participants. All non-aggregated statistics presented herein are available in the public domain. The inputs for US aggregated statistics are widely available in the market but may be subject to individual confidentiality obligations. Although believed to be reliable, information obtained from third party sources has not been independently verified and its accuracy or completeness cannot be guaranteed.

Legal & General Retirement America is a business unit of Legal & General America, Urbana, MD. Legal & General America life insurance and

retirement products are underwritten and issued by Banner Life Insurance Company, Urbana, MD and William Penn Life Insurance Company of New

York, Valley Stream, NY. Banner products are distributed in 49 states, the District of Columbia and Puerto Rico. William Penn products are distributed

exclusively in New York; Banner Life is not authorized as an insurer in and does not do business in New York. The Legal & General America

companies are part of the worldwide Legal & General Group. CN08132025-1

Read the full L&G Global PRT Monitor here

Speak with a Pension Risk Transfer Expert Today

Have questions on Pension Risk Transfer? Our team can help you address your derisking needs with our custom solutions. Contact us today to learn more.

Stay Up to Date with the PRT Market

Our quarterly PRT Monitors outline Pension Risk Transfer market trends and performance. Sign up to get Pension Risk Transfer news straight to your inbox.

Previous PRT Market Reports

Read our previous Pension Risk Transfer news and see for yourself how the market has developed over the last several years. Download and review our previous PRT Monitors below.